Wall Street Story: A Brief History

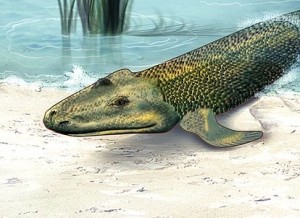

Early traders dealt in limited commodities, so any emerging market was seized upon. A bull market in ocean floor bacteria led to this trading frenzy, establishing the term "liquid asset."

But the smart players sought fresh opportunities. Young J.P. Morgan discovered dry land, envisioning factories and regal summer homes, ushering in The Gill Dead Age.

As increasing areas of dry land became industrialized, a new breed of traders and investors evolved. The American Dream had arrived.

Yet mega-profits led to complacency, blinding investors to possible dangers on the horizon.

After the crash, the economy stagnated for centuries, luring traders into money pits where many lost more than their shirts.

Eventually, the economy stabilized, releasing the innovative energy of American business leaders.

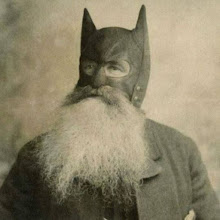

Some protested what they viewed as corporate "theft," but posed no threat to the status quo.

Mergers and consolidations streamlined the workforce, imposing fiscal discipline that attracted new investors.

Today, traders engage new challenges, making us the envy of the modern world.

<< Home